Welcome to Notary Depot!

An exclusive web directory

for notary professionals.

List your notary services, have a home on the web.

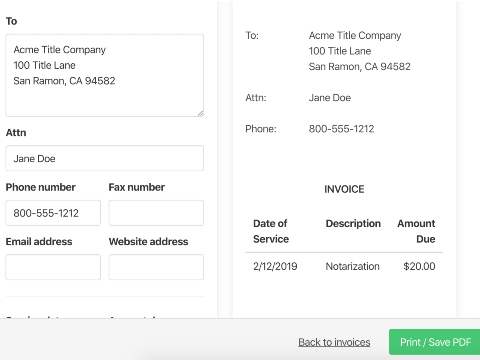

Create simple invoices for your notary jobs.

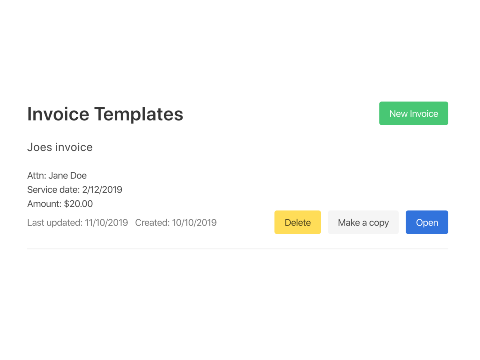

Manage the invoices you've sent out for your notary work.

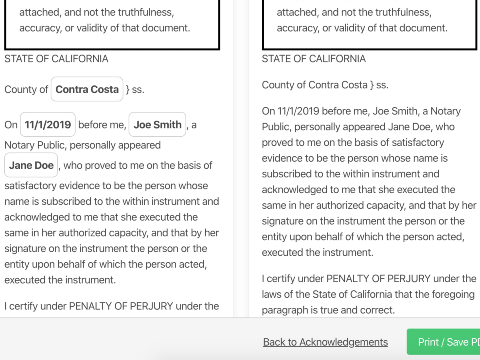

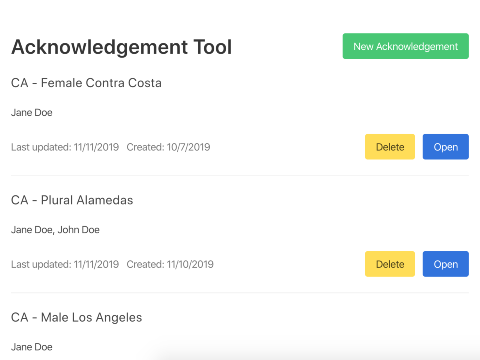

Track the acknowledgements and jurats you've created.

Create acknowledgements and jurats for your state with easy fill-in forms.